Lithium, which is crucial to electric vehicle (EV) and energy storage system (ESS) growth, demands a deep understanding of the intricate supply and price dynamics at play. But market volatility – from supply deficits to shifts in industry policy – has created a climate of risk and uncertainty.

Gain clarity with Fastmarkets' a comprehensive suite of products made for industry insiders and investors. Improve decision making with access to accurate data, forecasts and reports that are critical to the EV and ESS value chains. Whether it’s spot pricing, short- or long-term projections, our trusted insights stem from 150 years of specialty commodity expertise.

Interested in test driving our solutions?

Fill in the form and one of our experts will be in touch to arrange your free demo.

Learn more about our prices and forecasts

Navigate volatility in the battery raw materials market with confidence

Lithium prices

Trade and negotiate contracts confidently with transparent, unbiased, market-reflective prices benchmarked across energy commodity markets. Our price data is back by accredited and IOSCO-compliant methodologies.

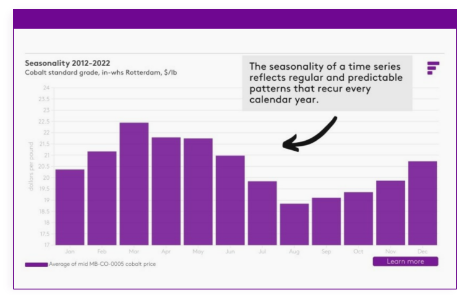

Battery raw materials short-term forecasts

Make informed decision on buying and selling with out short-term forecasts, which provide a two-year outlook on prices for lithium, cobalt, graphite, manganese and nickel and insights examining market supply, demand, cost and trade flow..

Long-term lithium forecasts

Gain a crystal-clear view on how the market is set to evolve in the next decade with our long-term forecasts, which include an in-depth review of suture supply, price outlooks and analyses on ESG and political considerations.

Meet our experts

Recognized by