Soybean crush margins: What lies behind the downward trend?

In this report, we answer some of the key questions we’re hearing from the market:

1. What do soybean crush volumes look like today?

2. What is the impact on export and import?

3. What is the impact on crush margins?

Extreme weather is negatively affecting the world’s soybean production. The phenomenon of La Niña heavily reduced South American yields and upset growth in U.S. production for the 2020-21 season.

The decline in production has slowed soybean crushing in several regions, and mainly in China, the world’s largest soybean importer.

As periods of drought become more frequent and a new La Niña event is forecast to strike in the near future, major soybean producers like Argentina struggle to meet export demand, with yields being challenged and projections uncertain.

Low availability and increased demand for soybean oil push prices up.

So, where does this leave soybean crushers? How are their margins being affected?

Click here to access 4 interactive charts showcasing:

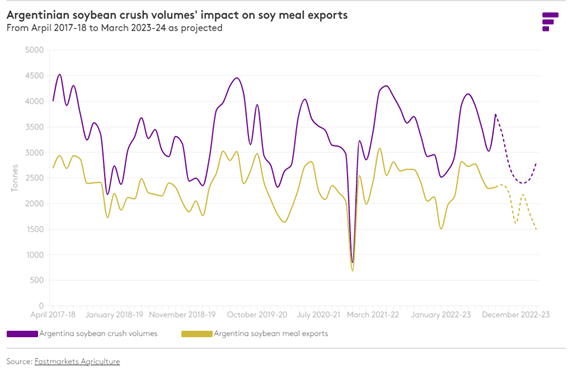

- Argentinian soybean crush volumes’ impact on exports, including 2022-23 forecasts

E.g.:

-

EU soybean crush volumes trends, including 2022-23 forecasts

-

China’s import and crushing trends, including 2022-23 forecasts

-

Chinese crush margins trend